How Many People Self-Track?

Gary Wolf

January 30, 2013

(Co-written with Ernesto Ramirez.)We were fascinated by the conversation started Monday by the release of the Pew survey about self-tracking by Susannah Fox. As with any survey research, the top line results provoked the most discussion, and also some intelligent skepticism. We’ve had a few days to digest the results, and here’s our analysis of the two key questions:

1. How many Americans use technology for self-tracking?

2. Is this number growing, shrinking, or staying the same?

The always reliable Brian Dolan and MobiHealthNews pointed out that according to Pew, health-tracking numbers were unchanged since their last report in 2010. While the questions asked are not identical, it’s logical to conclude from the two surveys that the numbers are flat. Susannah Fox, who wrote the Pew report, states this clearly: “One in five trackers in the general population (21%) say they use some form of technology to track their health data, which matches our 2010 finding.”1

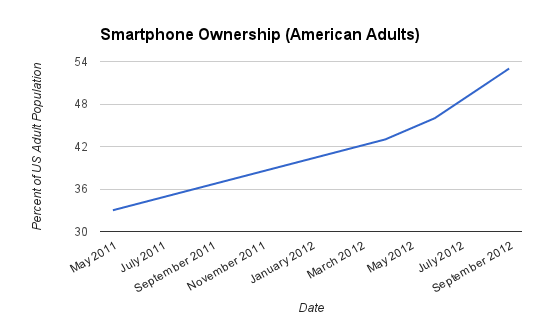

But wait; if this is true it is unexpected and therefore important. With thousands of new apps, and dozens if not hundreds of new medical tracking devices released in the last two years, the total number of Americans using them barely grew. According to Pew, the number of people using apps on their phones to track health has only increased from 9% in 2011 to 11% in 2012. Meanwhile, according to Pew smartphone ownership has increased from 33% to 53% from 2011 to 2012.2

Should we conclude that the spread of health tracking is not even close to keeping up with technology adoption generally? That, while smartphone usage grows, self-tracking stagnates?

A recent fitness tracking report by Forrester makes a parallel argument. Sarah Rotman Epps, the report’s author, argues that the potential US market for fitness trackers totals a relatively tiny 8 million adults. We have high faith in the underlying integrity of the Pew Research, which comes from direct questions asked to a random sample of adults, and less faith in the Forrester numbers, which come from an online panel and some creative theorizing, but thinking critically about both of them has helped us advance our own ideas about what’s going on with self-tracking generally.

Forrester’s research method was to ask an online panel if they were interested in buying a Fuelband, along with a series of lifestyle questions. They ran a regression to produce a profile of a likely Fuelband buyer, took this as a proxy for fitness wearables generally, used demographic data to calculate the number of potential buyers of all types of fitness wearables. To wit: 8 million.

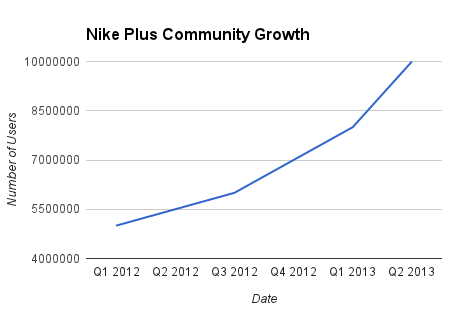

This is startlingly small, especially given Nike’s claims about how many people participate in the Nike+ ecosystem of tracking apps and devices, which includes the FuelBand. We’ve extracted the data in graph below from from transcripts of Nike’s quarterly calls with analysts:

On the latest call, in late 2012, Nike announced it had 10 million Nike+ users. We asked Sarah, the author of the Forrester report, to comment. “Nike is saying they have 10 million plus users,” she replied by email, “most of which are likely just using the app and their shoes. We are saying that the market for purchasing actual fitness tracking devices is quite small.”

How does this claim look in light of the Pew numbers? If you look at current census estimates and the Pew data then we see that almost 35 million3 US adults are using technology to self-track. Of those, 8% use a medical device, like a glucose meter and 7% use an app or other tool on their mobile phone or device. Combined that comes to 5 million adults. And yet if we take Nike at it’s word, and we assume that Nike+ appls and devices fall into either the medical device or mobile app category, then the Nike+ ecosystem alone includes many more self-trackers than Pew found in their survey.

Obviously these are partial views of a complex reality, based on very different types of data, but it would nice to have a theory that was compatible with all the evidence.

To sum up: smartphone adoption is growing quickly; Nike+ participation is growing quickly, but the number of people using technology to track their health appears flat, and the total market for fitness tracking devices is tiny.

We have some ideas about how to solve this mystery, but we’d like to hear what you think first. We’ll follow up with a post based on your comments and our own further thoughts.

1: In an email dialog we had with Susannah Fox she urged us to look at the full reports, especially the exact questions that were asked in the two surveys. You can check them here: 2011: The Social Life of Health Information and 2012: Tracking for Health. We’ll get into some details in our next post.

2: This data is available as part of the 2012 Tracking for Health report (pg. 18).

3: We calculated this by combing the Pew findings with the current estimates of the US adult population. More specifically we used the following calculation: (US adult population – 238,640,000) x (total trackers – 69%) x (technology trackers – 21%) = 34,578,936.